EURIS DYNAMICS APPS

APP

Localization in Italy

All-in-One Financial Platform for Business Central

Introduction

Finally, on AppSource, the application that makes localization in Italy simple for foreign companies!

Our app is specifically designed to assist foreign companies in establishing and operating within the Italian market. With extensive and meaningful experience in the Italian market, we bring a deep understanding of local business dynamics and requirements.

We offer comprehensive knowledge of Italian regulations, including tax and legal requirements, ensuring full compliance. Our solution is tailored to meet fiscal and regulatory standards, making it easy for businesses to navigate the complexities of the Italian system.

Our local support and technical assistance ensure that companies have access to continuous help when needed. The app is adapted to integrate seamlessly with local systems and government entities, facilitating smooth operations.

We also provide fully localized documentation and training, helping your team get up to speed quickly. Additionally, our expertise extends to supporting financial and commercial operations, ensuring your business operates efficiently and in full compliance with local practices.

With Microsoft certifications and strong local partnerships, we offer reliable, cutting-edge solutions that are both effective and compliant with Italian standards.

App – Localization in Italy

This is a software solution developed by Gruppo Euris, designed to extend the financial capabilities of Microsoft Dynamics Business Central. Compliant with Microsoft standards, this application provides advanced tools for accounting management, management control, and financial analysis, ensuring native integration with the Dynamics ecosystem.

Thanks to its flexibility and scalability, the app allows foreign companies to easily adapt to the legal and fiscal regulations of the Italian market, integrating functionalities such as:

Self-Invoicing

Virtual Stamp Duty

Declaration of Intent – Plafond

Electronic Invoicing

Mandatory Open-Entries Management

Reopening VAT Settlement

Extra G/L Entries

Performa Monitor

Split Payment

Agent Commissions

Self-Invoicing

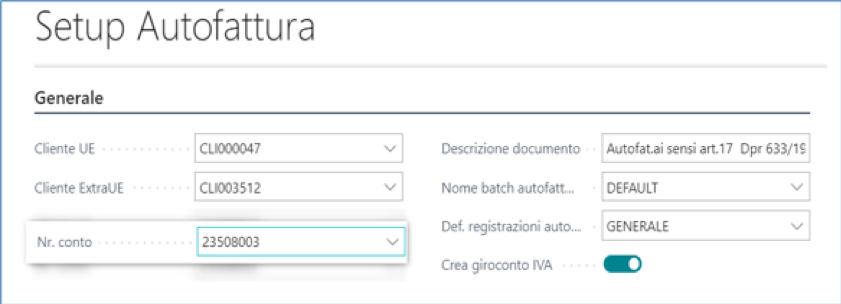

The app automatically generates the self-invoice whenever a purchase invoice or purchase credit note is registered.

Among its key features, users can:

1.

Set the VAT reversal

2.

Create a “self-invoice” transit account

3.

Define a “self-invoice” customer

The app automatically manages the cases provided for by Article 17, paragraph 2 of DPR 633/1972, where a company is required to issue a self-invoice for the purchase of services from non-EU countries. The process includes the automatic creation of dated and numbered sales documents, ready to be recorded in the sales and purchase VAT registers, ensuring full compliance and smooth operations.

Each operation is fully customizable to meet the specific needs of the client.

Virtual Stamp Duty

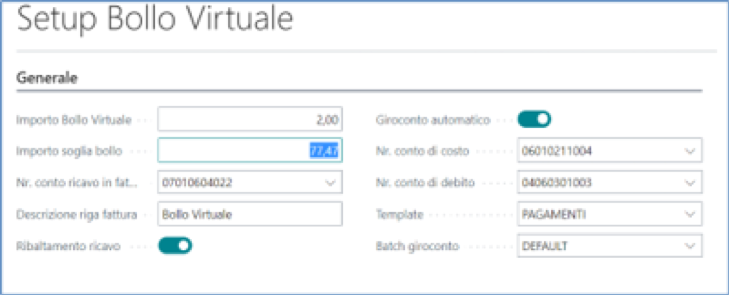

The Virtual Stamp Duty module is a specific solution for Microsoft Dynamics Business Central that automates the management of virtual stamp duty, applying it automatically when VAT is not applicable.

Among its key features, users can:

Set the virtual stamp duty amount and the revenue account

Define the threshold amount at which the stamp duty is applied

Customize the description that appears in the stamp duty line of the document

Automatically generate the revenue line for the stamp duty and the journal entry from the cost account to the debit account

Choose the cost and debit accounts for the journal entry

This makes it possible to charge the stamp duty to the customer, with the related amount being recorded, ensuring the entire process is quick, efficient, and compliant with tax regulations.

Declaration of Intent – Plafond

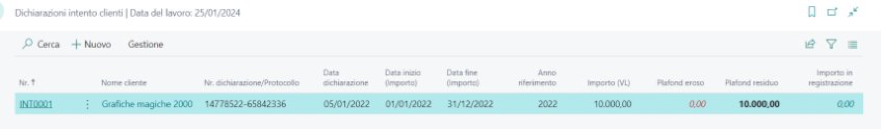

The Declaration of Intent module is a specific solution for Microsoft Dynamics Business Central that simplifies and automates the management of declarations of intent for customers and suppliers, ensuring compliance with fiscal regulations.

The app allows for automatic verification of the presence of the declaration of intent and calculates the erosion of the plafond, managing any overdrafts by blocking registrations.

Key features include:

Automatic verification of the presence of the declaration of intent for customers and suppliers

Calculation of the erosion of the plafond and blocking of registrations if limits are exceeded

Automatic management of the plafond restoration in case of credit notes

Monitoring and automatic calculation of overdrafts to avoid issues related to non-compliant transactions

The app ensures transparent and accurate management of the entire process, ensuring that declarations of intent are always correct and up-to-date. The automatic management of plafond erosion and the ability to block registrations in case of overdraft reduce the risk of errors and ensure continuous compliance with current fiscal regulations.

Electronic Invoicing

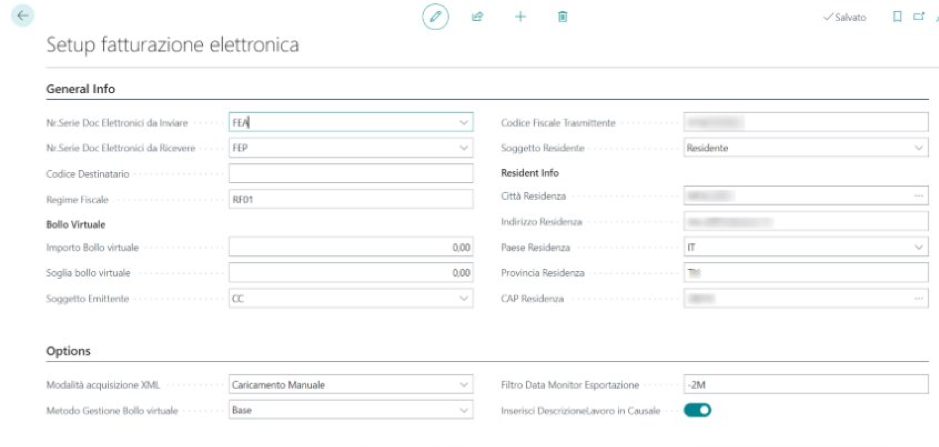

The Electronic Invoicing module is an integrated solution for Microsoft Dynamics Business Central that automates the generation and submission of purchase and sales XML files to the SDI (Sistema di Interscambio – Italian Exchange System).

The app enables efficient management of the entire electronic invoicing process, from document issuance to import and validation.

Key features include:

Single and bulk generation of XML files for sales invoices

Automatic import of XML files for purchase invoices, with the option to create invoice headers

Comprehensive management of document data (including Supplier, Customer, General data, Stamp duty, Discounts, Sales orders, Delivery notes, Declarations of intent, Invoice line details, VAT summary, Payment terms, and Reasons)

Bulk export of XML documents with pre-validation to detect and correct errors before submission

Attachment of PDF files and other documents for complete and compliant invoice management

The app allows for the automation of the entire electronic invoicing process, reducing manual data entry and the risk of errors. The use of data matching ensures accurate association of information, improving both fiscal and accounting management. Additionally, the ability to export documents in bulk and validate them prior to submission enables a more efficient and secure workflow, minimizing the risk of non-compliance.

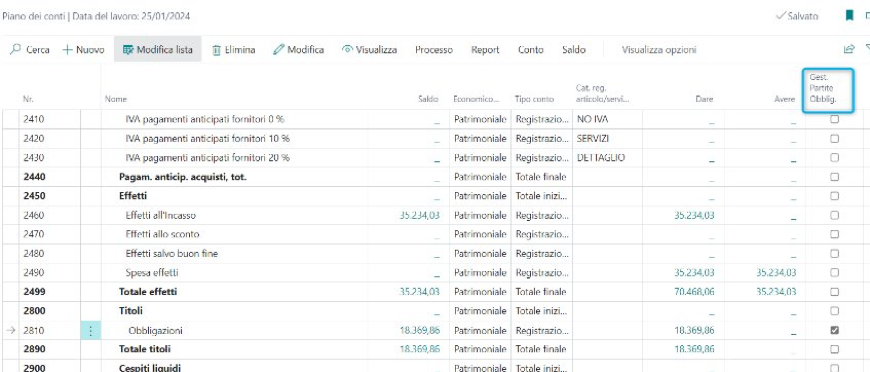

Mandatory Open-Entries Management

The Mandatory Open Entries Management module is a solution designed for Microsoft Dynamics Business Central that enables the handling of accounts not directly affecting customer/vendor balances through an open entries management system.

The app simplifies the management of general ledger accounts not directly linked to the balance sheet accounts of customer/vendor master data, allowing for precise and compliant accounting entries.

Key features include:

Mandatory open entries management – for each accounting entry on accounts with open entry management, it is mandatory to associate a customer or vendor, ensuring that every transaction is properly linked to the relevant master data;

Automated matching of entries – when opening balances, the system automatically matches entries by master data and amount, marking them as closed;

Open entries balance view – the open entry balances can be viewed from both the general ledger account and the customer/vendor card, offering clear and transparent transaction tracking and monitoring.

The app allows for the automated management of mandatory open-entry accounting transactions, simplifying reconciliation and reducing the risk of errors. The direct visibility of open and closed entries from different master data perspectives improves control and traceability of balances, ensuring greater accuracy in financial operations.

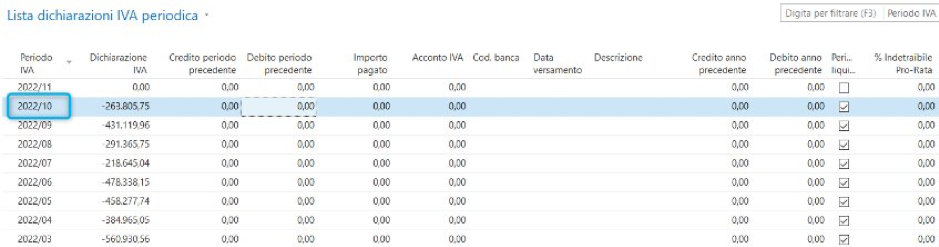

Reopening VAT Settlement

The app provides a simplified process for handling corrections related to VAT settlement, ensuring a high level of efficiency and accuracy.

Key features:

Automatic reopening of VAT settlements – allows reopening of a previously closed VAT period to make modifications or corrections to the data;

Deletion of accounting entries – once the VAT settlement is reopened, related accounting entries are automatically deleted, keeping the system accurate and up to date.

The app is designed to remain fully compliant with fiscal regulations, reducing the risk of errors or penalties.

Its intuitive interface enables users—even those without advanced accounting expertise—to perform reopening and deletion operations quickly and securely.

Accessible from any device, the app ensures safe, remote management and is fully compatible with cloud platforms.

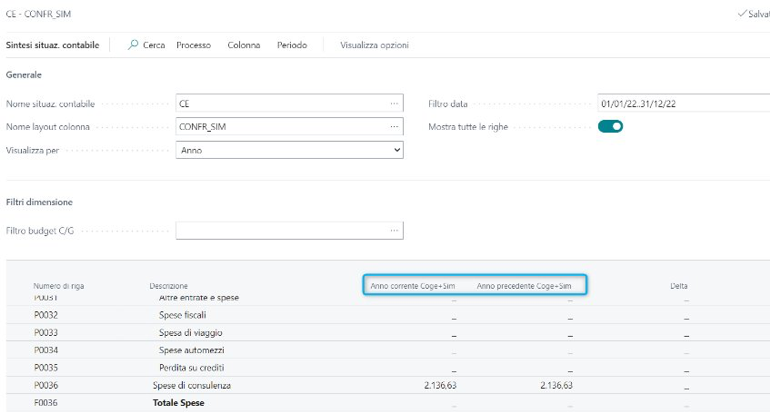

Extra G/L Entries

The Extra G/L Entries module is an advanced solution for Microsoft Dynamics Business Central that supports the management of Extra G/L Entries, essential for the preparation of periodic financial statements.

Key features include:

Management of Extra G/L Entries – allows the recording of managerial journal entries required for the preparation of monthly, quarterly, and semi-annual financial statements;

Automatic posting of adjustment entries – automates the registration of accruals and deferrals, simplifying the recognition of revenues and expenses;

Competence tracking – enables the definition and monitoring of items to be included in periodic reports;

Comprehensive chart of accounts – supports the recording of managerial entries and facilitates the drafting of financial statements;

Accounting scenario management – ensures the completeness and accuracy of data for financial statement preparation.

The app simplifies the adjustment process, reducing the risk of errors and improving efficiency in managing periodic financial reporting. With its ability to automate adjustment entries and competence management, it is an ideal solution for companies needing to prepare financial statements quickly and accurately.

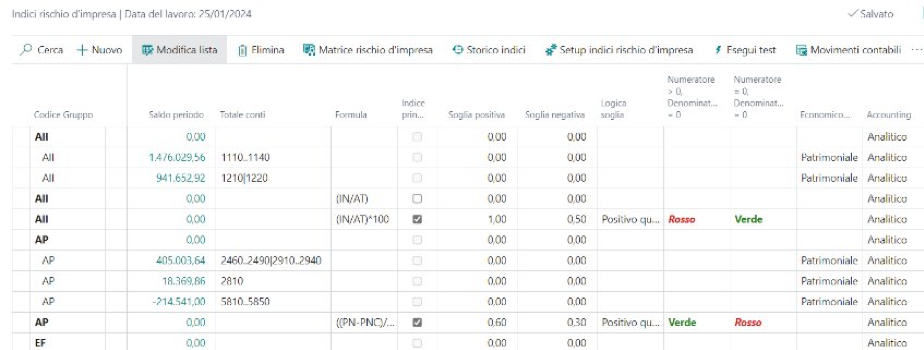

Performa Monitor

The Performa Monitor module is an advanced solution for Microsoft Dynamics Business Central that enables the management and monitoring of corporate KPIs.

This application is designed to support businesses in risk analysis and in measuring economic, financial, and asset performance through the creation and processing of multiple indicators.

Key features include:

Unlimited KPI management: Performa Monitor allows the creation and tracking of an unlimited number of KPIs, tailored to the specific needs of each business;

Threshold settings: Users can define positive and negative thresholds for each KPI, enabling continuous and accurate performance monitoring;

Alert system: The app sends email notifications whenever a KPI exceeds its predefined threshold, allowing for timely intervention;

Real-time monitoring: Provides autonomous, real-time access to ERP data, ensuring a constantly updated view of the business status;

Data history: Daily data archiving enables the generation of accurate trends and analysis over different observation periods;

Interactive charts and customizable dashboards: Users can visualize trends for each KPI and personalize their dashboards by including the most relevant business charts;

Detailed KPI analysis: Offers drill-down capabilities for each KPI to gain deeper insight into business performance;

Cost and profit center monitoring: Enables tracking of individual cost and profit centers, optimizing resource management.

With Performa Monitor, companies can easily and dynamically manage their performance indicators, enhancing analytical capabilities and responsiveness to performance changes, while improving overall business efficiency and control.

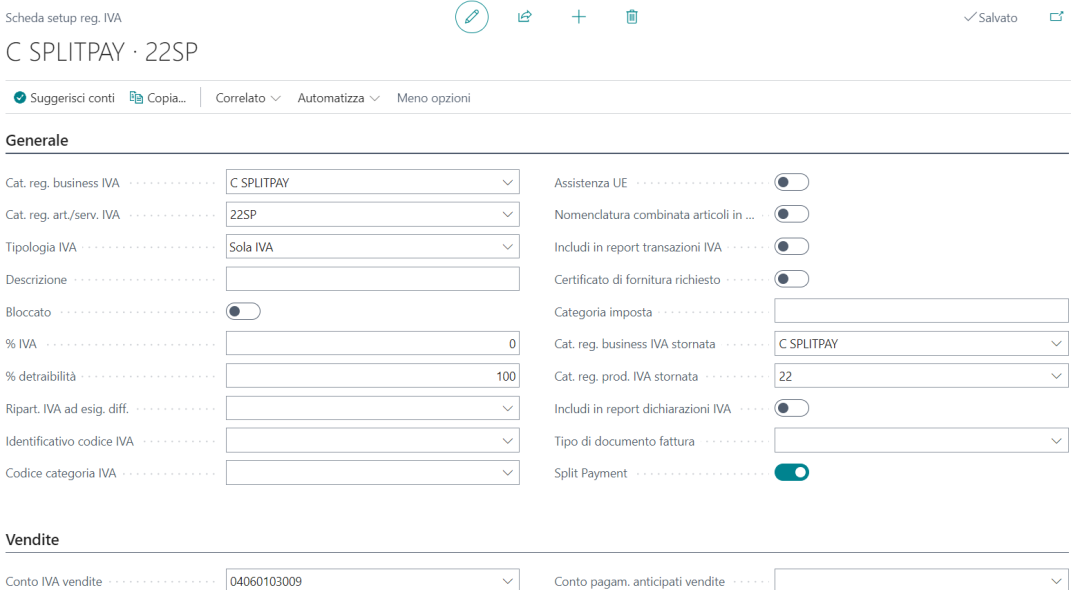

Split Payment

The “Split Payment” module streamlines the management process of VAT split and reclassification by automatically activating them based on the VAT business posting groups. The app is compatible with all types of companies, regardless of industry or size. Once installed, it is immediately operational and does not require additional configuration, ensuring quick user adoption and minimal technical intervention.

The core functionality concerns the Automation of Split Payment: the app automatically triggers the VAT split and reclassification at the time of posting, based on the VAT categories configured at the business level.

The system enables better traceability of transactions subject to split payment, enhancing transparency and transaction monitoring, with positive impacts on internal controls and tax compliance.

By separating VAT from the main payment, the company can temporarily benefit from the VAT amount, improving cash flow management and allowing for more efficient use of financial resources.

Automation reduces the risk of human error or omission, mitigating the possibility of penalties or tax liabilities resulting from non-compliant practices. The company can thus accurately demonstrate proper VAT management in accordance with regulations.

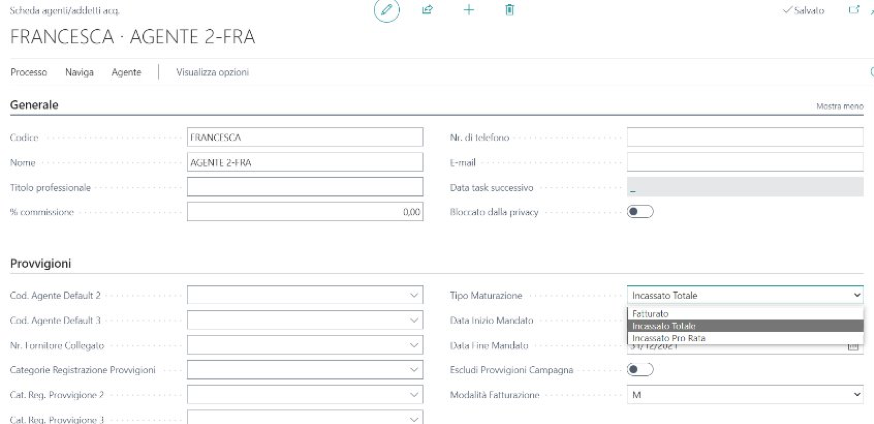

Agent Commissions

The Commissions application for Microsoft Dynamics 365 Business Central is a tool designed to support companies in the calculation, monitoring, and management of sales agent commissions. The solution enables the automation of commission processes, ensuring consistency in calculations and traceability in accounting and administrative operations.

Key Features:

User-managed commission setup: Commission calculations are fully manageable by users and can be modified at any time. The setup allows specifying categories such as agent, customer, and product.

Flexible commission rules: Commissions may vary for the same combinations, depending also on the discounts granted by the agent to the customer, allowing for highly detailed pricing.

Automated purchase invoice creation: It is possible to generate a purchase invoice (linked to the supplier) directly from agent-related notes. The system will automatically populate the line with the commission G/L account and the monthly total.

Multiple calculation bases:

– Invoiced amount: Commissions are calculated based on the value of issued invoices.

– Collected amount: Calculations are tied to actual collections, ensuring alignment with received payments.

– Partial collection: The solution handles cases of partial payments, automatically calculating commissions in proportion to the amount collected.

Management of accrued and recalculable commissions: The app supports dynamic management of commissions, enabling recalculation in case of payment updates or document changes. This ensures consistent and up-to-date management of agent entitlements.

Commission statement issuance: It is possible to issue a summary note detailing the calculated commissions for each agent, supporting reporting and payment processes.

The Commissions app for Business Central automates agent commission calculations, reducing manual errors and improving operational efficiency. It offers flexibility based on the contractual model (invoiced, total or partial collection) and ensures traceability and transparency through detailed documentation and seamless ERP integration.

At a glance…

The Italian Localization App, focused on the Finance modules of Microsoft Dynamics 365 Business Central, is an essential solution for foreign companies operating in the Italian market. By integrating features that comply with local tax and accounting regulations—such as VAT management, withholdings, split payment, and electronic reporting—the app ensures a high level of compliance, reducing operational risks and streamlining administrative processes.

Its added value lies in the ability to provide a fully integrated, comprehensive localization, enabling international companies to stay aligned with their global ERP infrastructure while ensuring efficiency, operational continuity, and regulatory compliance.